UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter) | |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||

o | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

(1) | ||||

Title of each class of securities to which transaction applies: | ||||

(2) | ||||

Aggregate number of securities to which transaction applies: | ||||

(3) | ||||

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

(4) | ||||

Proposed maximum aggregate value of transaction: | ||||

(5) | ||||

Total fee paid: | ||||

o | ||||

Fee paid previously with preliminary materials. | ||||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | ||||

Amount Previously Paid: | ||||

(2) | ||||

Form, Schedule or Registration Statement No.: | ||||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

125 HIGHWAY 515 EAST

BLAIRSVILLE, GEORGIA 30514-0398

March 24, 2020

Dear Fellow Shareholder:

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

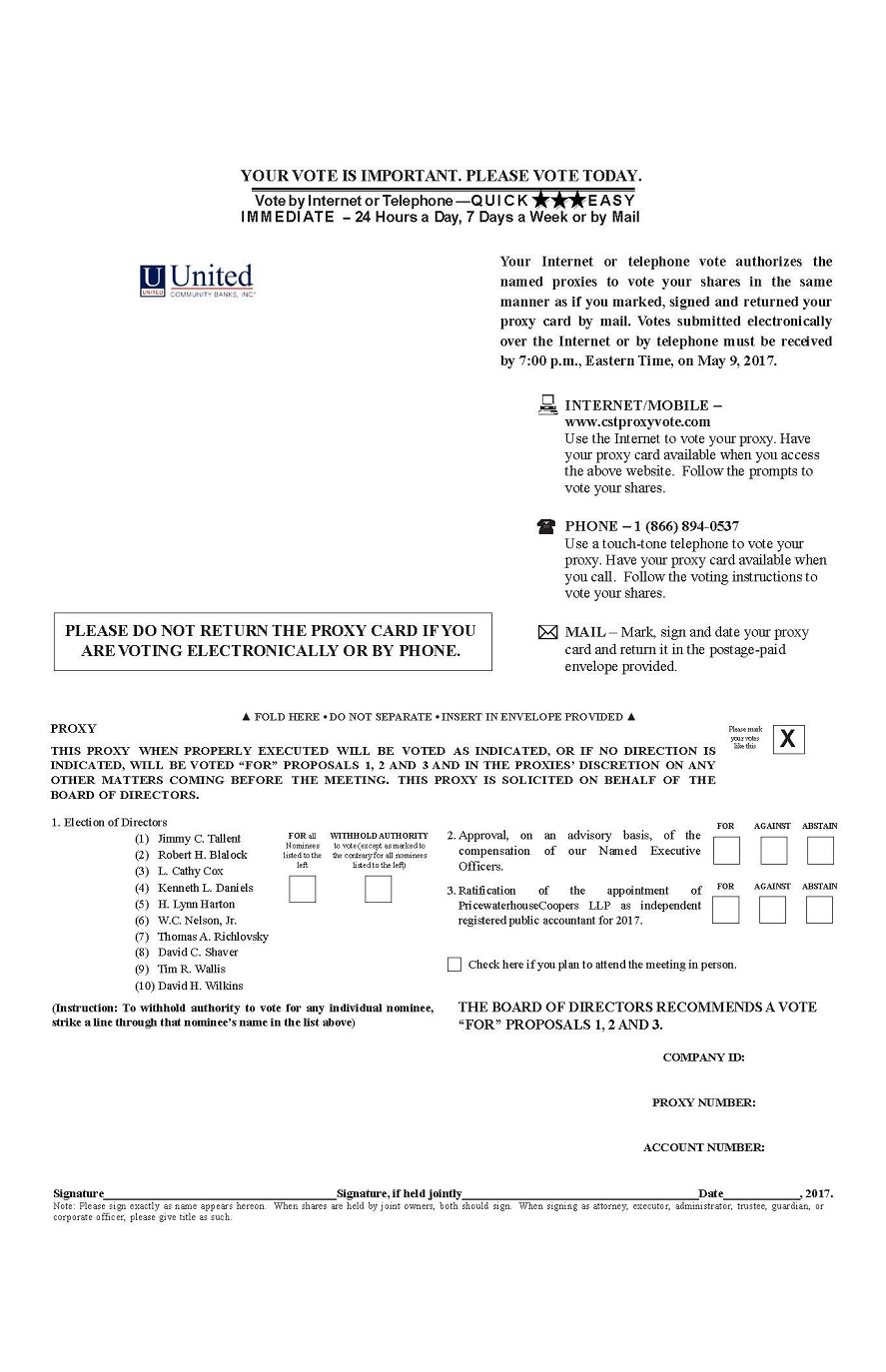

The 2017You are cordially invited to attend the 2020 Annual Meeting of Shareholders of United Community Banks, Inc. (“United”)The 2020 Annual Meeting of Shareholders will be held on May 10, 2017 at 2:306 East North Street, Greenville, South Carolina 29601 at 1:00 p.m. at The Ridges Resort, 3499 Highway 76 West, Young Harris, Georgia. This yearEastern time on Wednesday, May 6, 2020. Although we plan to hold the 2020 Annual Meeting of Shareholders, our typical annual meeting could pose a health threat to the participants and the greater community. In making your own decision regarding whether to attend the 2020 Annual Meeting of Shareholders, we advise you will be asked to vote ontake into account the following itemscurrent health environment, the risks to your personal health and the health of business:

Only shareholdersothers if you were to attend, and the advice of record at the close of business on March 11, 2017 will be entitledhealth authorities to notice of, and to vote at, the meeting. A Notice of Internet Availability of Proxy Materials is enclosed.

use social distancing.

We have again elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rule to help conserve resources and reduce printing and distribution costs. We will be mailing arules. The accompanying Notice of Internet Availability2020 Annual Meeting of Shareholders and Proxy MaterialsStatement describes the matters to our shareholders, instead of a paper copybe acted upon and, and in addition to being available at www.proxyvote.com as part of our “Proxy Materials,” which include this Proxy Statement,proxy materials, is also available at our 2016corporate website www.ucbi.com. The Annual Report to Shareholders and our Annual Report on Form 10-K for the year ended December 31, 2016, with instructions on how to access such Proxy Materials2019 are also available at our corporate website. We believe that providing our proxy materials over the Internet.

Internet increases the ability of our shareholders to obtain the information they need, while reducing the environmental impact of the 2020 Annual Meeting of Shareholders and our costs associated with the physical printing and mailing of proxy materials.

It is important that your shares arebe represented and voted at the 20172020 Annual Meeting of Shareholders. ToEven if you anticipate attending in person, we urge you to please vote either by mail, telephone or over the Internet to ensure that your shares will be represented. If you attend, you will, of course, be entitled to vote is recorded promptly,in person. If you need help at the 2020 Annual Meeting of Shareholders because of a disability, please vote as soon as possible. Many shareholderscontact us at least one week in advance of record have multiple optionsthe meeting at (866) 270-5900.

I look forward to updating you on developments in our business at the 2020 Annual Meeting of Shareholders.

Sincerely, | |

| |

H. LYNN HARTON President and Chief Executive Officer |

YOUR VOTE IS IMPORTANT

PLEASE VOTE EITHER BY MAIL, TELEPHONE OR OVER

THE INTERNET WHETHER OR NOT YOU EXPECT TO ATTEND

THE 2020 ANNUAL MEETING OF SHAREHOLDERS.

125 HIGHWAY 515 EAST

BLAIRSVILLE, GEORGIA 30514-0398

NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of United Community Banks, Inc.:

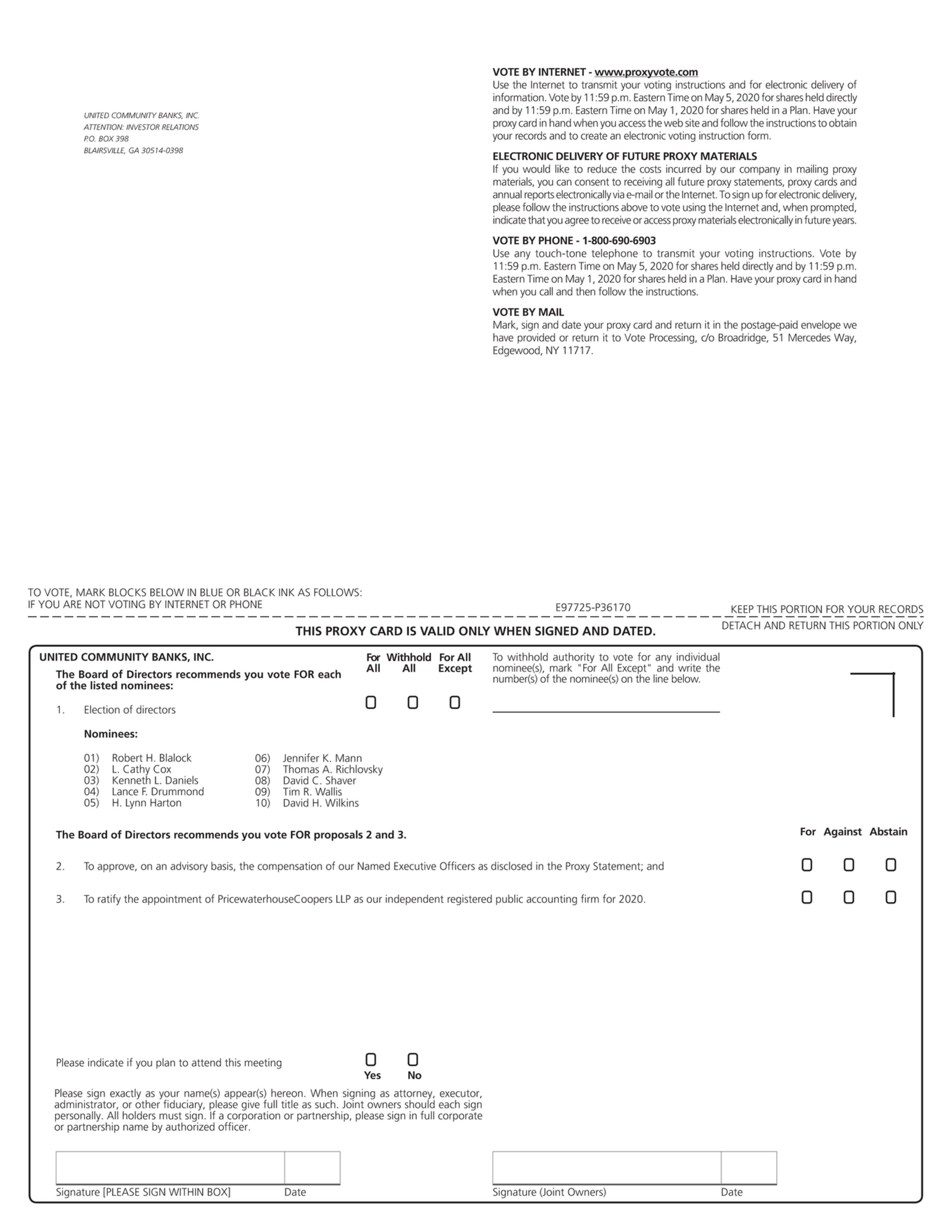

The 2020 Annual Meeting of Shareholders of United Community Banks, Inc., a Georgia corporation, will be held at 306 East North Street, Greenville, South Carolina 29601 at 1:00 p.m. Eastern time on Wednesday, May 6, 2020 for submitting their vote before the meeting. You may vote via the Internet or telephone (see instructions onfollowing purposes:

| (1) | To elect the ten nominees listed in the accompanying Proxy Statement to the Company’s Board of Directors; |

| (2) | To approve, on an advisory basis, the compensation paid to our Named Executive Officers; |

| (3) | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants for the fiscal year ended December 31, 2020; and |

| (4) | To transact such other business as may properly be presented at the 2020 Annual Meeting of Shareholders or any adjournment thereof. |

We plan to send a Notice of Internet Availability of Proxy Materials)Materials (the “Notice”) to our shareholders instead of paper copies of our Proxy Materials (this Notice of 2020 Annual Meeting of Shareholders and Proxy Statement, our 2019 Annual Report to Shareholders, our Annual Report on Form 10-K for the year ended December 31, 2019 and the Proxy Card or voting instruction form). Or, if you are a registered shareholder and have not voted online by April 17, 2017, you may receive a second mailing with the proxy card andThe Notice, which is expected to be mailed to shareholders on or about March 24, 2020, contains instructions on how to vote by completing, signing and mailing the accompanying proxy card in the postage-paid envelope to be provided. If you have Internet access we encourage you to record your voteour materials on the Internet. ItInternet as well as instructions on obtaining a paper copy of the Proxy Materials. The Notice is convenient,not a form for voting and it saves significant postagepresents only an overview of the Proxy Materials.

The Board of Directors has fixed the close of business on March 9, 2020 as the record date for determining shareholders entitled to notice of and processing costs. If you attendto vote at the meeting you may, if you wish, withdraw your proxy and vote in person.

If your shares are held in “street name,” meaning that your shares are held for your account by a broker or other nominee, you will receive instructions from the holder2020 Annual Meeting of record that you must follow for your shares to be voted.Shareholders.

By order of the Board of Directors, | |

| |

Melinda Davis Lux | |

General Counsel and |

Blairsville, Georgia

March 31, 2017

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE 2017 ANNUAL MEETING OF SHAREHOLDERS,

PLEASE VOTE BY TELEPHONE OR INTERNET PROMPTLY SO THAT YOUR VOTE MAY BE RECORDED.

24, 2020

TABLE OF CONTENTS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 6, 2020

This Notice of 2020 Annual Meeting of Shareholders, our Proxy Statement, our 2019 Annual Report to Shareholders, our Annual Report on Form 10-K for the year ended December 31, 2019 and the Proxy Card or voting instruction form (the “Proxy Materials”) are available at www.proxyvote.com. You will need your Notice of Internet Availability or Proxy Card to access the Proxy Materials at www.proxyvote.com. A copy of our Proxy Materials (with the exception of the Proxy Card) can also be found on our corporate website, www.ucbi.com (Investor Relations > Financials & Filings).

As permitted by rules adopted by the Securities and Exchange Commission (“SEC”), we are furnishing our Proxy Materials over the Internet to some of our shareholders. This means that some shareholders will not receive paper copies of these documents but instead will receive only a Notice of Internet Availability containing instructions on how to access the Proxy Materials over the Internet and how to request a paper copy of our Proxy Materials. Shareholders who do not receive a Notice of Internet Availability will receive a paper copy of the Proxy Materials by mail unless they have previously requested delivery of Proxy Materials electronically.

March 31, 2017

125 HIGHWAY 515 EAST

BLAIRSVILLE, GEORGIA 30514-0398

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of United Community Banks, Inc. (“United”) for use at the 20172020 Annual Meeting of Shareholders (the “Annual Meeting”)of the Company to be held on Wednesday, May 10, 2017 at 2:00 p.m. at The Ridges Resort, 3499 Highway 76 West, Young Harris, Georgia, and at any adjournments or postponements of the 2017 Annual Meeting. For directions to the 2017 Annual Meeting, visitwww.theridgesresort.com or call (866) 270-5900 and an Investor Relations professional can assist you.6, 2020

In this Proxy Statement, we use terms such as “we,” “us,” “our,” “United” and the “Company” to refer to United Community Banks, Inc. and its subsidiary, United Community Bank (the “Bank”). We also sometimes refer to the Board of Directors of United Community Banks, Inc. as the “Board.” Additionally, we use terms such as “you” and “your” to refer to our shareholders.

In this Proxy Statement, we refer to the Notice of Annual Meeting of Shareholders, this Proxy Statement, our 2016 Annual Report to Shareholders and our Annual Report on Form 10-K for the year ended December 31, 2016 voting instruction form as our “Proxy Materials.”

SOLICITATION, MEETING AND VOTING INFORMATION ABOUT THE PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials For The Shareholder Meeting To Be Held On May 10, 2017

We have posted materials related to the 2017 Annual Meeting on the Internet. The following materials are available on the Internet atwww.cstproxy.com/ucbi/2016:

| Q: | What documents constitute our “Proxy Materials”? |

| A: | The Proxy Materials include the Notice of 2020 Annual Meeting of Shareholders, the Proxy Statement, our 2019 Annual Report to |

| Q: | What is a proxy, who is asking for it, and who is paying for the cost to solicit it? |

| A: | A proxy is your legal designation of another person, called a “proxy,” to vote your stock. The document that designates someone as your proxy is also called a proxy or a “Proxy Card.” |

Why did IOur Directors, officers, and employees are soliciting your proxy on behalf of our Board of Directors (the “Board”). Those persons will not receive a noticeadditional payment or compensation for doing so except reimbursement for any related out-of-pocket expenses. We will, upon request, reimburse brokers, banks, custodians and similar organizations for their expenses in the mail regarding the Internet availability of the Proxy Materials instead of a paper copy of the Proxy Materials?

In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we may furnish ourforwarding Proxy Materials to our shareholdersbeneficial owners. Solicitation of proxies by providing access to such documents on the Internet instead of mailing printed copies. The Notice of Internet Availability of Proxy Materials was first sent or given to shareholders on March 31, 2017.

All shareholders will have the ability to access the Proxy Materials via the Internet by going towww.cstproxy.com/ucbi/2016 or by requesting to receive a printed set of such Proxy Materials. Instructions on how to access the Proxy Materials over the Internet or to request a printed copymail may be found onsupplemented by telephone, personal contact, email and other electronic means, advertisements and personal solicitation, or otherwise. The Company will pay the Noticeexpense of Internet Availabilityany proxy solicitation. We have not hired a proxy solicitor to assist in the solicitation of Proxy Materials.

INFORMATION ABOUT THE ANNUAL MEETING

What will I be voting on at the 2017 Annual Meeting?

This year you will be asked to vote on the following items of business:

proxies.

1

Will other matters be voted on at the 2017 Annual Meeting?

We are not aware of any other matters to be presented at the 2017 Annual Meeting other than those described in this Proxy Statement. If any other matters not described in the Proxy Statement are properly presented at the meeting, proxies will be voted in accordance with the best judgment of the proxy holders.

All shareholders of record of United’s Common Stock at the close of business on March 11, 2017, which is referred to as the record date, are entitled to receive notice of the 2017 Annual Meeting and to vote the shares of Common Stock held by them on the record date. Each outstanding share of Common Stock entitles its holder to cast one vote for each matter to be voted upon.

What other information should I review before voting?

You should review United’s 2016 Annual Report to Shareholders and its Annual Report on Form 10-K filed with the SEC, including financial statements for the year ended December 31, 2016, before voting. Copies of these documents may be obtained without charge by:

| A: | Please vote proxies for all accounts to ensure that all your shares are voted. You may consolidate multiple accounts with matching name(s) / registration through our transfer agent, Continental Stock Transfer & Trust. Email cstmail@continentalstock.com or call (800) 509-5586 to confirm if your accounts can be consolidated. All requests for consolidation must be submitted in writing. |

| Q: | Who may attend the 2020 Annual Meeting? |

| A: | Although we plan to hold the 2020 Annual Meeting, our typical annual meeting could pose a health threat to the |

YouOnly shareholders, their proxy holders, and our invited guests may also obtain copies of United’sattend the 2020 Annual Report on Form 10-K by accessing the EDGAR database at the SEC’s website atwww.sec.govor from the SEC at prescribed rates by writing to the Public Reference Room of the SEC, 100 F. Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) SEC-0330 for further information.

If you hold your shares of Common Stock in your own name as a holder of record and you have Internet access, United prefers that you vote your shares via the Internet by going towww.cstproxyvote.com. Alternatively, you may vote your shares by telephone if you reside in the United States, Canada or the United States territories or in person at the 2017 Annual Meeting.

If you are a registered shareholder and have not voted your shares by April 17, 2017, you may receive a proxy voting card by mail. At that time, you may also vote by mail by completing the proxy card and following the instructions provided.

If your shares of Common Stock are heldregistered in “streetthe name” meaning that your shares are held for your account by of a broker, trust, bank or other nominee, you will receive instructionsneed to bring a proxy or a letter from your nominee which you must follow in order to vote your shares.

Proxies that are submitted through the Internet or, if applicable, executed and returned via mail, but do not contain any specific instructions on any proposal, will be voted “FOR” the proposals specified herein.

If you are a record holder youor your most recent brokerage account statement that confirms your ownership of those shares as of March 9, 2020. For security reasons, we also may revoke your proxy by:

require photo identification for admission.

Any shareholder of record as of the record date attending the 2017 Annual Meeting may vote in person by ballot whether or not a proxy has been previously given, butRestated Bylaws, as amended (the “Bylaws”) provide that the presence (without further action) of a shareholder at the 2017 Annual Meeting will not constitute revocation of a previously given proxy.

Any shareholder holding shares in “street name” by a broker or other nominee must contact the broker or nominee to obtain instructions for revoking the proxy instructions.

How many votes must be present to hold the 2017 Annual Meeting?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the 2017 Annual Meeting. As of the record date, there were 70,966,488 voting shares of Common Stock outstanding and entitled to vote at the 2017 Annual Meeting.

What vote is required to approve each proposal?

The required vote for each proposal at the 2017 Annual Meeting is as follows:

Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum. Additionally, broker nonvotes are included in the calculation of the number of votes considered to be present at the 2020 Annual Meeting for purposes of determining the presence of a quorum only when there are “routine” matters to be voted upon. Because there is a “routine” matter to be voted upon at the 2020 Annual Meeting, broker nonvotes also will be included for purposes of determining a quorum. See What are “broker votes” and “broker nonvotes”? for additional information.

| A: | Only shareholders of record at the close of business on March 9, 2020 (the “Record Date”), are entitled to notice of and to vote at the 2020 Annual Meeting. As of that date, there were 78,505,706 shares of our Common Stock, $1.00 par value, issued and outstanding and entitled to be voted at the 2020 Annual Meeting. Each share of our Common Stock is entitled to one (1) vote on each matter considered at the 2020 Annual Meeting. |

| Q: | Will a list of shareholders entitled to vote at the 2020 Annual Meeting be available? |

| A: | Yes. A list of shareholders entitled to vote at the 2020 Annual Meeting will be available after March 9, 2020 at our executive office and will be accessible there through the date of the 2020 Annual Meeting during ordinary business hours. |

2

| Q: | What am I voting on at the 2020 Annual Meeting? |

| A: | There are three proposals to be considered and voted on at the 2020 Annual Meeting: |

We will also consider other business that properly comes before the 2020 Annual Meeting in accordance with Georgia law and our Bylaws.

| Q: | What are my choices when voting on the election of |

| A: | Regarding the vote |

For any other business at the 2017 Annual Meeting, the vote of a majority of the voting shares of Common Stock voted on the matter, assuming a quorum is present, shall be the act of the shareholders on that matter, unless the vote of a greater number is required by law.

How arecounted?for all director nominees.

Proposal 1 is the election of directors. Because directorsDirectors are elected by a plurality of the votes cast except as described in Proposal 1: Electionat the 2020 Annual Meeting of Directors — Majority Vote Requirement,Shareholders by the director nominees who get the most votes will be elected even if such votes do not constitute a majority. Directors cannot be voted “AGAINST,” and votes to “WITHHOLD AUTHORITY” to vote for a certain nominee will have no impact if the nominee receives a plurality of the votes cast. For the approval of all other proposals, you may vote “FOR” or “AGAINST” the proposal.

Abstentions and “broker non-votes” will be counted only for purposes of establishing a quorum, but will not otherwise impact the vote. “Broker non-votes” are proxies received from brokers or other nominees holding shares on behalf of their clients (in “street name”) who have not been given specific voting instructions from their clients with respect to non-routine matters. The ratification of independent auditors is considered a routine matter by brokers and other nominees allowing them to have discretionary voting power to vote shares they hold on behalf of their clients for the ratification of an independent auditor.

If you hold your shares of Common Stock in your own name as a holder of record and you fail to vote your shares, eitherrepresented in person or by proxy and entitled to vote on the election of directors at the 2020 Annual Meeting of Shareholders provided a quorum is present. Withholding of authority to vote in the election and broker nonvotes will not impact the outcome of the election, provided a quorum is present. As a result, the ten nominees receiving the highest number of “FOR” votes will be elected as directors.

Our Board, however, has a majority vote policy, which provides that nominees for director who are elected but receive less than a majority of the votes cast for the election of directors may be asked to resign. The Board could waive this majority vote requirement in situations such as when a general campaign against the election of a class of directors of public companies resulted in a United nominee being elected with less than a majority vote without consideration of the particular facts and circumstances applicable to the individual United nominee. The Board would not waive the majority vote policy, however, if the votes cast resulted from a campaign directed specifically against the election of an individual United nominee, even in circumstances in which a majority of the Board disagrees with those voting against that director’s election.

| Q: | What are my choices when voting on the advisory (nonbinding) proposal regarding the compensation paid to the Company’s Named Executive Officers (“say-on-pay proposal”), and what vote is needed to approve the advisory say-on-pay proposal? |

| A: | Regarding the advisory (nonbinding) proposal on the compensation paid to our Named Executive Officers, shareholders may: |

The affirmative vote of a majority of the shares represented at the 2020 Annual Meeting of Shareholders and entitled to vote is required to approve, on an advisory basis, the say-on-pay vote. As an advisory vote, this proposal is not binding upon us. However, our Talent and Compensation Committee, which functions as our Compensation Committee and is referred to throughout this Proxy Statement as the “Compensation Committee,” and which is responsible for designing and administering our executive compensation program, values the opinions expressed by our shareholders and will consider the outcome of the vote when making future compensation decisions.

3

| Q: | What are my choices when voting on the ratification of the appointment of PwC as the Company’s independent registered public accountants for the fiscal year ending December 31, 2020, and what vote is needed to ratify their appointment? |

| A: | Regarding the vote on the proposal to ratify the appointment of PwC as the Company’s independent registered public accountants for 2020, shareholders may: |

The affirmative vote of a majority of the shares represented at the 2020 Annual Meeting of Shareholders and entitled to vote is required to approve the proposal to ratify the appointment of PwC as our independent registered public accountants for 2020.

| Q: | How does the Company’s Board of Directors recommend that I vote? |

| A: | See the information included in this Proxy Statement relating to the proposals to be considered and voted on at the 2020 Annual Meeting. Our Board of Directors unanimously recommends that you vote: |

| Q: | How do I vote? |

| A: | If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust, you are considered a shareholder of record with respect to those shares. If you are a record holder, the Notice is being sent to you directly by Broadridge Financial Solutions. Please carefully consider the information contained in this Proxy Statement and, whether or not you plan to attend the 2020 Annual Meeting, please vote by (i) accessing the Internet website specified on the Notice, (ii) calling the toll-free number specified on your Proxy Card, if you requested printed copies of the Proxy Materials or (iii) marking, signing and returning your Proxy Card promptly, if you requested printed copies of the Proxy Materials, so that we can be assured of having a quorum present at the 2020 Annual Meeting and so that your shares may be voted in accordance with your wishes, even if you later decide to attend the 2020 Annual Meeting. |

If you hold shares in the name of a broker, bank or other nominee you may be able to vote those shares by Internet or telephone depending on the voting procedures used by your broker, bank or other nominee. See How do I vote if my shares are held in “street name” by a broker, bank or other nominee? for additional information.

| Q: | How do I vote if my shares are held in “street name” by a broker, bank or other nominee? |

| A: | If your shares are held by a broker, bank or other nominee (this is called “street name”), your broker, bank or other nominee will send you instructions for voting those shares. Many (but not all) brokerage firms, banks and other nominees participate in a program provided through Broadridge Investor Communication Solutions that offers Internet and telephone voting options. |

| Q: | If I vote by proxy, can I still attend the 2020 Annual Meeting and vote there if I choose? |

| A: | Yes. If you are a shareholder of record, the method you use to vote will not limit your right to vote at the 2020 Annual Meeting if you decide to attend in person. Written ballots will be passed out to any shareholder of record who wants to vote at the 2020 Annual Meeting. However, if your shares are held in street name by a broker, bank or other nominee and you would like to attend the 2020 Annual Meeting and vote your shares in person, you must obtain a proxy from your bank or broker. You must request this form from your bank or broker; they will not automatically supply one to you. |

4

| Q: | Is cumulative voting allowed? Do I have dissenters’ or appraisal rights? |

| A: | No. Cumulative voting rights are not authorized, and dissenters’ rights and rights of appraisal are not applicable to the matters being voted upon at the 2020 Annual Meeting. |

| Q: | What are “broker votes” and “broker nonvotes?” |

| A: | On certain “routine” matters, brokerage firms have discretionary authority under applicable stock exchange rules to vote their customers’ shares if their customers do not provide voting instructions. When a brokerage firm votes its customers’ shares on a “routine” matter without receiving voting instructions (referred to as a “broker vote”), these shares are counted both for establishing a quorum to conduct business at the 2020 Annual Meeting and in determining the number of shares voted “FOR” or “AGAINST” the “routine” matter. For purposes of the 2020 Annual Meeting, Proposal 3 – the ratification of the appointment of PwC as the Company’s independent registered public accountants for 2020 is considered a “routine” matter. |

Under applicable stock exchange rules, Proposal 1 – the election of directors and Proposal 2 – the advisory (nonbinding) vote on the compensation of our Named Executive Officers (say-on-pay vote) are considered “nonroutine” matters for which brokerage firms do not have discretionary authority to vote their customers’ shares if their customers did not provide voting instructions. Therefore, for purposes of the 2020 Annual Meeting, if you hold your stock through a brokerage account, your brokerage firm may not vote your shares on your behalf on either (i) Proposal 1 - the election of directors and (ii) Proposal 2 – the advisory (nonbinding) vote on the compensation of our Named Executive Officers (say-on-pay vote) without receiving instructions from you. When a brokerage firm does not have the authority to vote its customers’ shares or does not exercise its authority, these situations are referred to as “broker nonvotes.” Broker nonvotes are only counted for establishing a quorum and will have no impact on the outcome of the vote.

We encourage you to provide instructions to your brokerage firm, bank or other nominee by voting your proxy. This action ensures your shares will be excluded entirely fromvoted at the vote.

How can I pre-register to attend the 2017 Annual Meeting?

To pre-register to attend the 20172020 Annual Meeting you may:

on all matters being considered.

| A: | You have the option to “ABSTAIN” from voting with respect to Proposal 2 – the advisory (nonbinding) vote on the compensation paid to our Named Executive Officers (say-on-pay vote) and Proposal 3 – the ratification of the appointment of PwC as the Company’s independent registered public accountants for 2020. Abstentions with respect to these proposals are counted for purposes of establishing a quorum. If a quorum is present, abstentions will have the same impact as a vote against these proposals. |

| Q: | May I revoke my proxy after I have delivered my proxy? |

| A: | Yes. You may revoke your proxy at any time before the polls close by submitting a subsequent proxy with a later date by using the Internet, by telephone or by mail or by sending our Corporate Secretary a written revocation. Your proxy also will be considered revoked if you attend the 2020 Annual Meeting and vote in person. If your shares are held in street name by a broker, bank or other nominee, you must contact your broker, bank or other nominee in order to change your vote or obtain a proxy to vote your shares if you wish to cast your vote in person at the 2020 Annual Meeting. |

| Q: | How will my shares be voted if I return my Proxy Card or vote via telephone or Internet? What if I return my Proxy Card but do not provide voting instructions or if I complete the telephone or Internet voting procedures but do not specify how I want to vote my shares? |

| A: | Our Board of Directors has named H. Lynn Harton, our President and Chief Executive Officer, and Thomas A. Richlovsky, our Lead Director, as official proxy holders. They will vote all proxies, or record an abstention or withholding, in accordance with the directions on the proxy. |

All shares represented by properly executed proxies, unless previously revoked, will be voted at the 2020 Annual Meeting as you direct.

If you sign and return your Proxy Card but give no direction or complete the telephone or internet voting procedures but do not specify how you want to vote your shares, with regard to Proposal 1, the shares will be

5

voted “FOR ALL” director nominees; with regard to Proposal 2, “FOR” the advisory (nonbinding) vote on the compensation paid to our named executive officers (say-on-pay vote) and, with regard to Proposal 3, “FOR” the ratification of the appointment of PwC as our independent registered public accountants for 2020.

| A: | An inspector of elections will be appointed for the 2020 Annual Meeting who will tabulate votes cast by proxy or in person at the 2020 Annual Meeting as well as determine whether a quorum is present. |

| Q: | Where can I find voting results of the 2020 Annual Meeting? |

| A: | We will announce preliminary voting results at the 2020 Annual Meeting and |

| Q: | Does the Board of Directors know of any other matters that might arise at the 2020 Annual Meeting? |

| A: | The Board of Directors knows of no matters to be presented at the 2020 Annual Meeting other than those set forth in the Notice of 2020 Annual Meeting of Shareholders enclosed herewith. However, if any other matters do come before the 2020 Annual Meeting, it is intended that the holders of the proxies will vote thereon in their discretion. Any such other matter will require for its approval the affirmative vote of a majority of votes cast by shares represented in person or by proxy and entitled to vote at such 2020 Annual Meeting, provided a quorum is present, or such greater vote as may be required under the Company’s Amended and Restated Certificate of Incorporation, our Bylaws or applicable law. |

| Q: | May I propose actions for consideration at the 2020 Annual Meeting of Shareholders or nominate individuals to serve as directors? |

| A: | Yes; however, to do so you must have given timely notice of the business in writing to the Corporate Secretary of the Company. To be timely, your notice must be delivered or mailed to and received at the principal offices of the Company on or before the later to occur of (i) 14 days prior to the 2020 Annual Meeting or (ii) 5 days after this notice is provided to you. Your notice to the Corporate Secretary must set forth a brief description of each matter of business that you propose to bring before the meeting and the reasons for conducting that business at the meeting; the name, as it appears on the Company’s books, and your address; the series or class and number of shares of our capital stock that are beneficially owned by you; and any material interest that you have in the proposed business. The chairman of the |

| A: | You may submit proposals for consideration at future shareholder meetings, including director nominations. See Proposal 1: Election of Directors > Can shareholders recommend or nominate directors? and Shareholder Proposals for 2021 Annual Meeting of Shareholders for additional information. |

| Q: | Whom should I contact with questions about the 2020 Annual Meeting? |

| A: | If you have any questions about this Proxy Statement or the 2020 Annual Meeting, please contact Melinda Davis Lux, our General Counsel and Corporate Secretary at United Community Banks, Inc., Post Office Box 398, Blairsville, Georgia 30514-0398 or by telephone at (800) 822-2651. If you need help at the Annual Meeting because of a disability, please contact us at least one week in advance of the 2020 Annual Meeting at (866) 270-5900. |

6

| What information is available on the Internet? |

| A: | A copy of this Notice of 2020 Annual Meeting of Shareholders, our Proxy Statement, our 2019 Annual Report to Shareholders, our Annual Report on Form 10-K for the year ended December 31, 2019 and the Proxy Card or voting instruction form (the “Proxy Materials”) are available at www.proxyvote.com. You will need your Notice of Internet Availability or Proxy Card to access the Proxy Materials at www.proxyvote.com. |

Additionally, we use our website, www.ucbi.com, as a channel of distribution for important Company information. We make available free of charge on our website (Investor Relations > Financials & Filings) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, ownership reports on Forms 3, 4 and 5 and any amendments to those reports as soon as practicable after we electronically file such reports with the SEC.

Information from our website is not incorporated by reference into this Proxy Statement.

7

1: ELECTION OF DIRECTORS

What is the structure of the Board of Directors?

TheOur Bylaws of United provide that the number of directors on United’sthe Board of Directors may range from eight to fourteen. The Board of United has set the current number of directors at ten. The number of directors may be increased or decreased from time to time by the Board by resolution, but no decrease shall shorten the term of an incumbent director. The terms of office for directors continue until the next2021 Annual Meeting of Shareholders and until their successors are elected and qualified. All of the directors of United also serve on the Board of the Bank.

How are directors identified and nominated?

The Nominating/Corporate Governance Committee is responsible for identifying, evaluating and recommending qualified director candidates, including the director slate to be presented to shareholders at the 2020 Annual Meeting, to our Board, which makes the ultimate election or nomination determination, as applicable. The Board of Directors nominates individuals for election to the Board based on the recommendations of the Bank. Nominating/Corporate Governance Committee. A candidate for the Board of Directors must meet the eligibility requirements set forth in United’s Bylaws and in any applicable Board or committee resolutions. See Can shareholders recommend or nominate directors? for information regarding how directors may be nominated by shareholders. The Nominating/Corporate Governance Committee may use a variety of methods to identify potential director candidates such as recommendations by our directors, management, shareholders or third-party search firms. The Company did not pay any fees to third parties in 2019 to identify or assist in identifying potential nominees.

Does the Board of Directors consider diversity when identifying director nominees?

Information Regarding NomineesYes. The Nominating/Corporate Governance Committee considers qualifications and characteristics that it, from time to time, deems appropriate when it selects individuals to be nominated for Directorelection to the Board of Directors and seeks to obtain candidates who will provide a diversity of viewpoints, professional experience, education and skills that complement those already existing on the Board. These qualifications and characteristics include, without limitation, the individual’s interest in United, his or her United shareholdings, independence, integrity, business experience, education, accounting and financial expertise, age, race, ethnicity, gender, education, reputation, civic and community relationships and knowledge and experience in matters impacting financial institutions. In addition, prior to nominating an existing director for re-election to the Board, the Nominating/Corporate Governance Committee will consider and review an existing director’s Board and committee attendance and performance.

How are nominees evaluated; What are the threshold qualifications?

The Nominating/Corporate Governance Committee is charged with recommending to our Board of Directors only those candidates that it believes are qualified to serve on the Board consistent with the criteria for selection of new directors adopted from time to time by the Board.

In determining whether a candidate’s suitability for consideration for membership on the Board, the Nominating/Corporate Governance Committee reviews all proposed nominees for the Board, including those proposed by shareholders, in accordance with the mandate contained in its charter. The Nominating/Corporate Governance Committee assesses a candidate’s independence, background, and experience, as well as our current Board’s skill needs. With respect to incumbent directors considered for re-election, the Nominating/Corporate Governance Committee also assesses each director’s meeting attendance record and suitability for continued service. In addition, the Committee determines whether nominees are in a position to devote an adequate amount of time to the effective performance of director duties and possess the following threshold characteristics: informed judgment, integrity and accountability, record of achievement, understanding of the Company’s business or other related industries, a cooperative approach, loyalty, the ability to consult with and advise management and such other factors as the Nominating/Corporate Governance Committee determines are relevant considering the needs of the Board and the Company. The Nominating/Corporate Governance Committee recommends candidates, including those submitted by shareholders, only if it believes a candidate’s knowledge, experience, and expertise would strengthen the Board and that the candidate is committed to representing the long-term interests of all United shareholders.

Who are the nominees this year?

All nominees for election as directors at the 2020 Annual Meeting, consisting of the ten incumbent directors who were elected at the 2019 Annual Meeting of Shareholders, were nominated by the Board of Directors for election by shareholders at the 2020 Annual Meeting upon the recommendation of the Nominating/Corporate Governance

8

Committee. Our Board believes that each of the nominees can devote an adequate amount of time to the effective performance of director duties and possesses all of the threshold qualifications identified above. If elected, each nominee would hold office until the 2021 Annual Meeting of Shareholders or until his or her successor is elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal.

Set forth below is information on each director and nominee, their ages at the date of this Proxy Statement and the calendar year in which they first became a director, along with a summary of their experience, qualifications, attributes and skills that qualify them for service on the Board. All of the nominees for director are existing directors that have been nominated by the Board for re-election.

Age | Business Experience During the Past Five Years and Other Information | ||

Robert H. Blalock | Director since 2000 Committee Membership Audit Nominating/ Corporate Governance | 72 | Mr. Blalock has been Chief Executive Officer of Blalock Insurance Agency, Inc. in Clayton, Georgia, since 1974. He served as an organizing director of First Clayton Bank and Trust when the bank was formed in 1988. He was a member of the board of directors and served on the Compensation and Audit Committees for First Clayton Bank and Trust, which was acquired by United in 1997, and was past Chairman of the board of directors. Mr. Blalock remains on the community bank board of United Community Bank — Clayton (the former First Clayton Bank and Trust) and joined United’s Board of Directors in 2000. Mr. Blalock is a graduate of University of Georgia and served as an Infantry Officer in the United States Army. He served a tour of duty in Vietnam with the 101 Airborne Division. He was a member of the Rotary Club of Clayton board of directors from 1974 to 1991 and served as the club’s Vice President. Mr. Blalock’s extensive knowledge and business experience, as well as involvement in our banking communities, provide critical insight to our Board. His experience and leadership of a small business in the Clayton community provides a much-needed perspective into a business community that is representative of a large portion of United’s service area. As a past member of the board of directors of First Clayton Bank and Trust, Mr. Blalock brings not only a rich history of banking leadership but a perspective of the bank acquisition process. The Board believes that Mr. Blalock’s 46 plus years of business experience and over 30 years of bank board experience make him well suited to serve on the Board of Directors. |

9

Age | Business Experience During the Past Five Years and Other Information | |

Mr. Blalock has been Chief Executive Officer of Blalock Insurance Agency, Inc. in Clayton, Georgia, since 1974. He served as an organizing director of First Clayton Bank and Trust when the bank was formed in 1988. He was a member of the board of directors and served on the Compensation and Audit Committees for First Clayton Bank and Trust, which was acquired by United in 1997, and was past Chairman of the Board. Mr. Blalock remains on the community bank board of United Community Bank — Clayton (the former First Clayton Bank and Trust) and joined United’s Board in 2000.

Mr. Blalock is a graduate of University of Georgia and served as an Infantry Officer in the United States Army. He served a tour of duty in Vietnam with the 101 Airborne Division. He was a member of the Rotary Club of Clayton board of directors from 1974 to 1991 and served as the club’s Vice President.

Mr. Blalock’s extensive knowledge and business experience, as well as involvement in our banking communities, provide critical insight to our Board. His experience and leadership of a small business in the Clayton community provides a much-needed perspective into a business community that is representative of a large portion of United’s service area. As a past member of the board of directors of First Clayton Bank and Trust, Mr. Blalock brings not only a rich history of banking leadership but a perspective of the bank acquisition process. The Board believes that Mr. Blalock’s 40 plus years of business experience and over 25 years of bank board experience make him well suited to serve on the Board.

L. Cathy Cox | Director since 2008 | |

Committee | ||

| Membership Executive Nominating/ Corporate Governance | ||

(Chair) Risk | 61 | Ms. Cox was appointed dean of Mercer University’s School of Law, Georgia’s oldest ABA-accredited law school, in 2017. Ms. Cox brings to the Mercer Law deanship a breadth and depth of experience in higher education, public service and the practice of law. Prior to this appointment, Ms. Cox served for ten years as President of Young Harris College, a private, liberal arts college in North Georgia. During her tenure at the college, she moved the college from two-year to four-year status, doubled student enrollment and the size of the faculty of the institution and added more than $100 million in new facilities to the campus. Prior to joining the college, Ms. Cox was twice elected to serve as the Georgia Secretary of State. In this role she served as Commissioner of Securities, overseeing the regulation of the securities industry within the state. Ms. Cox was twice elected to the Georgia House of Representatives where she served on the House Judiciary Committee; Game, Fish and Parks Committee; State Institutions and Properties Committee; Georgia Code Revision Commission and various House study committees. Prior to her public service, Ms. Cox worked in the private practice of law, first as an associate with Hansell & Post in Atlanta, Georgia, and then as a partner with Lambert, Floyd & Conger in Bainbridge, Georgia. She started her professional career as a newspaper reporter. Ms. Cox holds an A.S. degree from Abraham Baldwin Agricultural College, an A.B.J. degree from University of Georgia and a J.D. degree from Mercer University School of Law. She was Editor-in-Chief of the Mercer Law Review. She serves on the boards of several statewide nonprofit and civic organizations. Ms. Cox provides a unique combination of legal, governmental and educational experience to the Board of Directors. In her legal career, Ms. Cox served as legal counsel for community banks, hospitals and other businesses in Georgia. This, combined with her extensive government service, brings a depth of legal and governmental expertise to the Board. Her leadership in higher education demonstrates Ms. Cox’s vision and strong management skills and offers the perspective of key educational institutions to the Board. For these reasons, the Board of Directors believes Ms. Cox is well suited to serve on the Board. |

Ms. Cox has served as President of Young Harris College, a private, liberal arts college in North Georgia, since 2007. In her time at the college, she has moved the college from two-year to four-year status, doubled student enrollment and the size of the faculty of the institution and added more than $100 million in new facilities to the campus. Prior to joining the college, Ms. Cox was twice elected to serve as the Georgia Secretary of State. In this role she served as Commissioner of Securities, overseeing the regulation of the securities industry within the state, and she also participated in one of the largest ever national settlements against national investment banks for state and federal law violations.10

Ms. Cox was twice elected to the Georgia House of Representatives where she served on the House Judiciary Committee; Game, Fish and Parks Committee; State Institutions and Properties Committee; Georgia Code Revision Commission and various House study committees. Prior to her public service, Ms. Cox worked as an attorney, first as an associate with Hansell & Post in Atlanta, Georgia, and then as a partner with Lambert, Floyd & Conger in Bainbridge, Georgia. She started her professional career as a newspaper reporter. Ms. Cox holds an A.S. degree from Abraham Baldwin Agricultural College, an A.B.J. degree from University of Georgia and a J.D. degree from Mercer University School of Law. She was Editor-in-Chief of the Mercer Law Review.

Age | Business Experience During the Past Five Years and Other Information |

Ms. Cox provides a very unique combination of legal, governmental and educational experience to the Board. In her legal career, Ms. Cox served as legal counsel for community banks in Georgia. This, combined with her extensive government service, brings a depth of legal and governmental expertise to the Board. Her leadership of a college undergoing tremendous growth demonstrates Ms. Cox’s vision and strong management skills and offers the perspective of a key educational institution to the Board. For these reasons, the Board believes Ms. Cox is well suited to serve on the Board.

Kenneth L. Daniels | Director since 2015 Committee Membership Audit Compensation Executive Risk (Chair) | 68 | Mr. Daniels began his career at First Union National Bank (now Wells Fargo) where he served as a Senior Commercial Loan Officer and Commercial Financial Analyst. In 1983, he joined BB&T and led various credit and risk management functions as the company grew from $2 billion to $187 billion in assets. In 2003, he was promoted to Chief Credit Risk and Policy Officer and later to Senior Risk Advisor, a position he held until his retirement in 2014. Mr. Daniels is past President and Chair of both the Carolinas/Virginia Chapter and the Eastern North Carolina Chapter of the Risk Management Association (“RMA”). During his career, he served on the RMA’s National Agricultural Lending Council, the National Credit Risk Council, the Allowance for Loan and Lease Losses Roundtable and the Commercial Risk Grading Roundtable. He graduated from the RMA/Wharton Advanced Risk Management Program at The Wharton School of Business and also earned an M.B.A. degree at East Carolina University and a bachelor’s degree at the University of North Carolina, Chapel Hill. Mr. Daniel’s 38 years as a banking leader and risk professional with extensive experience in loan portfolio management, regulatory requirements, policy development and data integrity provides the Board of Directors with a depth of banking and risk expertise and offers the perspective of a large regional banking institution to the Board. For these reasons, the Board of Directors believes Mr. Daniels is well suited to serve on the Board. |

11